Trading In Lots & Margin Trading Explained

What Are The Types Of Spreads In Forex?

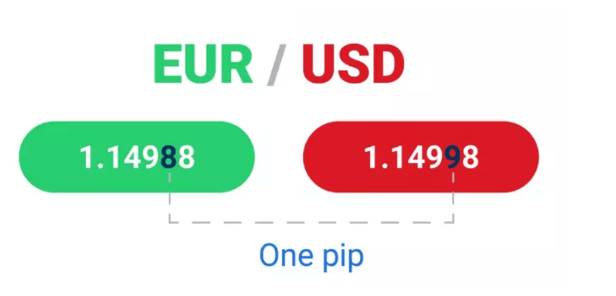

What Is A Pip?

The word pip is short for “percentage in point” and it is a unit of measurement used to express the change in value between two currencies.

For example:

If EUR/USD moved from 1.1498 to 1.1499, that .0001 increase in value for the USD is ONE PIP.

A pip is the fourth decimal place of forex price quotes which will usually be the last decimal place of a price quote. Most forex pairs have 4 decimal places, but there are some exceptions like the Japanese yen (JPY) pairs which only go to 2 decimal places.

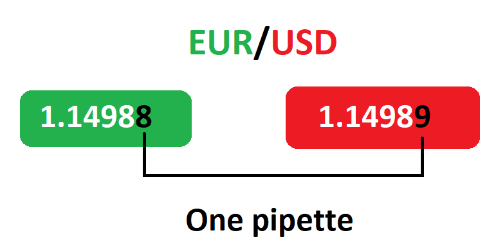

What is a Pipette?

In simple terms, a pipette is a fraction of a pip and has the value of 1/10 of a pip. A pipette is the 5th decimal place of an exchange rate for pairs as seen below:

For example:

If EUR/USD moves from 1.14988 to 14989 as seen in the example above, that .00001 USD increase in value is one PIPETTE.

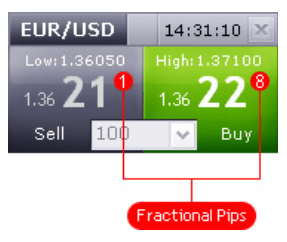

When you are on a trading platform, it will look something like this:

When you’re on a trading platform, the number expressing the value of a pipette usually appears to the right of the two larger numbers.

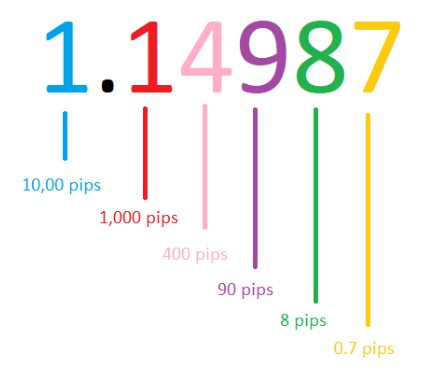

You can use the image below to assist you while learning about pips:

How to calculate the value of a Pip

Your forex broker will work all of this out for you automatically. But this does not mean that you’re wasting your time learning about pips because it’s always good for you to know how we work it out.

Each currency pair has its own relative value, therefore it is important to calculate the value of a pip for that particular currency pair.

We are going to look at a few examples to help you understand. In the first example, we will use a quote with 4 decimal places.

Example 1: USD/CAD = 1.1240

This should be read as 1 USD to 1.2400 CAD

In this example, the currency pair will increase in value from 1.2400 to 1.2401.

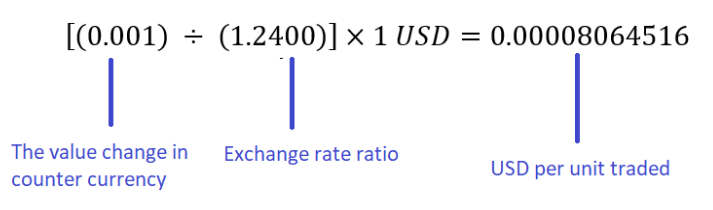

(Difference between counter currency) ÷ (the exchange rate ratio) x 1 USD = pip value (in terms of the base currency)

The calculation would look like this:

This means that if we traded 10,000 units of USD/CAD, a change of 1 pip to the exchange rate would be approximately a 0.80 USD change in the position value (10,000 x 0.00008065 USD/unit).

Example 2 : GBP/JPY = 155.087

This should be read as 1 EUR TO 1.8500 GBP.

View our different forex account types with different pip spreads and sign up with Vault Markets.