What moves currency pairs? Understanding fundamental analysis

What Is A Pip?

Trading In Lots & Margin Trading Explained

Trading in “Lots”

Think of forex trading like going to a grocery store. You are walking down the isles and decide that you want to buy an egg. But, you can’t just buy one single egg because they come in dozens or groups of 12.

In forex terms, we would say that they come in “lots” of 12.

With the same sense, you would be unable to buy or sell 1 dollar (USD) or 1 unit of currency, because they come in “lots” of 1 000 units of currency, 10 000 units, or 100 000 units depending on your forex broker and the account type you have.

Lot types:

- 1 000 units → micro lot

- 10 000 units → mini lot

- 100 000 units → standard lot

You cannot buy or sell 1 unit of currency on the forex market. You would need to buy or sell in lots of 1 000 units, 10 000 units or 100 000 units.

You may be thinking to yourself, “I do not have enough money to buy 10 000 dollars!”

Do not worry, you can still trade using leverage. This is where margin trading comes in.

Margin & Leverage Explained

Trading on margin is used to increase an investor’s buying power

When trading with leverage, you don’t need to pay the 10 000 dollars upfront. Rather, you’d put down a small “deposit”. This deposit is known as margin.

Basically, margin is the amount of money required to open a position.

Think of trading with leverage like buying a house. When you buy a house, you do not need to pay the full amount immediately. You would just need to pay a percentage of the value of the house as a down payment and the bank will loan you the rest, otherwise known as leverage in Forex.

Forex applies that same logic. If you wanted to open a $100,000 position. You do not need $100,000 to open this position the same way that you do not need $100,000 to buy the house. Depending on the leverage that your broker offers, you may just need $2,000 to open a position of $100 000.

Your $2,000 would be the margin and the remaining $98 000 would be the leverage provided to you to buy your broker.

This is an example of 50:1 leverage. This means that for every 1 dollar you deposit in your account, your broker will give you 50 dollars more. This is how you can take a $100,000 position with a deposit of $2,000 (2 000 margin x 50 leverage).

Margin trading lets you open large position sizes using only a fraction of the capital you’d normally require as seen above.

How can this affect your earnings or losses?

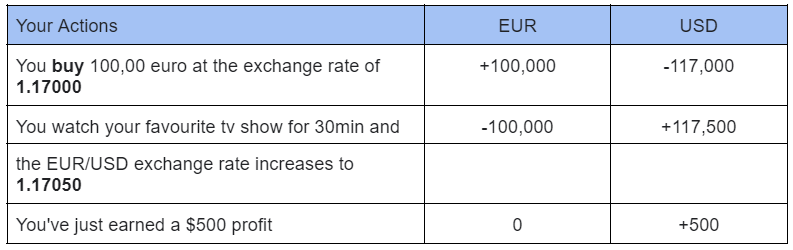

- You do your fundamental analysis and conclude that the euro is going to appreciate versus the U.S. dollar.

- You decide to open a standard lot (100,00 units of EUR/USD), buying with the U.S dollar with a 50:1 leverage.

- When you buy one lot (100,000 units) of EUR/USD at a price of 1.1700, you are buying €100,00, which is worth $117,000 (100,000 units of EUR x 1.1700)

- But because the margin requirement was 2%, you only need around $2,000 to open that position.

- $2,000 will be set aside in your account to open up the trade.

- You now control 100,000 euros with just $2,000

- Your analysis was correct and the euro increases versus the dollar, and you decide to sell 117,500. You make around $500.

Action Summary:

Let review that trade above:

- EUR/USD went up by just half a pence!

- But you made $500 while watching your favourite tv show!

- How? This is because you were not trading with just €1.

- Yes, if your position size was €1, you would’ve made only half a pence.

- But because your position size was €100,000 when you opened the trade, you can see these types of returns.

This is the power of leveraged trading. View our different forex account types with different leverage requirements and sign up to trade with Vault Markets.