What are currency pairs in forex?

What is bid, ask and spread in forex?

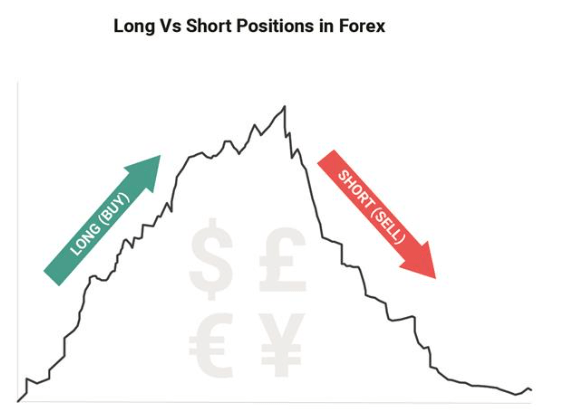

What is a long and short position in forex trading?

Understanding the basics of taking long or short positions in forex is fundamental for all beginner traders. Choosing to take a long or short position comes down to whether you as a trader believe that the base currency you are trading will go up or down in value compared to the quote currency.

If you buy, believing the base currency pair will decrease in value compared to the quote currency, then you will be taking a long position or “going long”.

Just remember: long = buy

If you sell, believing the base currency pair will decrease in value compared to the quote currency, you will be taking a short position or “going short”.

Just remember: short = sell

Let’s look into the mind of some traders to better understand “long” and “short” positions.

In the example above, the trader is thinking of trading EUR/USD with the belief that the base currency (EUR) would increase in value (appreciate) compared to the quote currency (USD). This would be an example of “going long” on EUR/USD.

In the example above, the trader is thinking of trading EUR/USD with the belief that the base currency (EUR) would decrease in value (depreciate) compared to the quote currency (USD). This would be an example of “going short” on EUR/USD.

These are the types of thoughts that would be going through the minds of individuals or institutional investors when trading on the forex market.

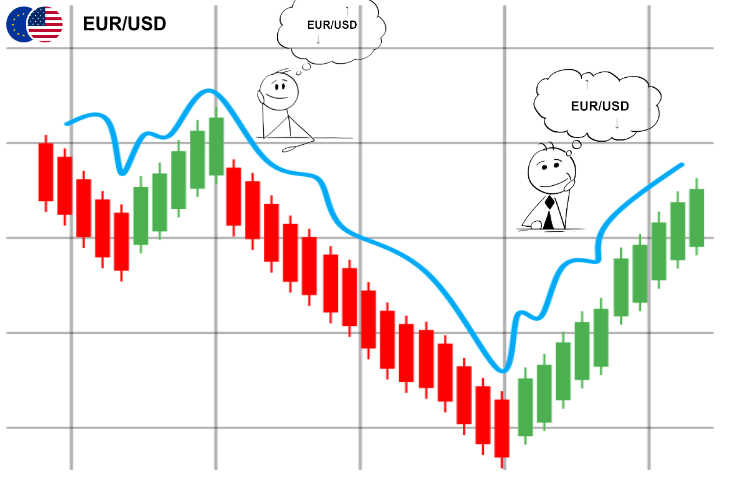

So, do not worry when you forex markets that look like this:

All it is, is basically individuals or institutes taking “long” or “short” positions in the market. Now you can sign up with Vault Markets and start your trading.