Visa

A Visa card is a type of credit card that is issued by a financial institution and branded with the Visa logo. It is accepted at millions of locations worldwide. A Visa card allows you to make purchases and withdraw cash. To get a Visa card, you must typically apply through the issuing financial institution and meet certain eligibility requirements.

Many banks in Africa offer Visa cards to their customers. Some examples include:

- Standard Bank of South Africa

- Absa Group Limited (formerly Barclays Africa Group Limited)

- First National Bank (FNB) of South Africa

- Ecobank Transnational Inc.

- Zenith Bank

- Access Bank

- United Bank for Africa (UBA)

This is by no means an exhaustive list, as there are many other banks in Africa that offer Visa cards. It is always a good idea to check with individual banks to see what types of credit cards they offer.

The time it takes for a transfer to go through with a Visa card can vary depending on the specific financial institutions and the country involved.

Domestic transfers within the same country are generally quicker than international transfers.

Transfers within the same financial institution may be available almost immediately or within a few hours, while transfers to a different financial institution may take one to three business days.

Some banks may offer expedited transfer services for an additional fee.

It is always a good idea to check with your bank or financial institution for specific information about transfer times and fees.

Banking apps require you to log in with a username and password in order to access your account and make transactions. This is for security purposes, as it helps to prevent unauthorized access to your account and protect your financial information.

By requiring you to log in to your banking app, financial institutions are able to provide a higher level of security and protect your accounts from fraudulent activity. It is important to keep your login credentials secure and not share them with anyone else in order to help protect your account.

Visa cards are considered to be safe to use, with security features such as EMV technology and fraud protection programs in place to help detect and prevent fraudulent activity.

Visa cards are not typically free, as there are often fees associated with obtaining and using them.

These fees can include annual fees, application fees, and charges for certain types of transactions.

It is important to carefully read and understand the terms and conditions of your Visa card, as fees and charges can vary depending on the issuer and the specific card.

As long as you have a Visa Card, you can deposit and withdraw on the Vault Markets platform with no additional registration.

Yes, you can use your Visa card on your phone through mobile apps or mobile wallet apps.

In order to use your Visa card on your phone, you will typically need to first activate the card and register it with your financial institution.

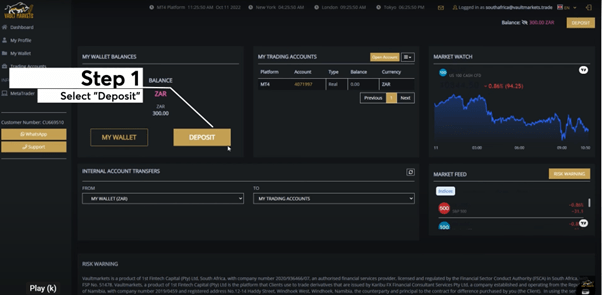

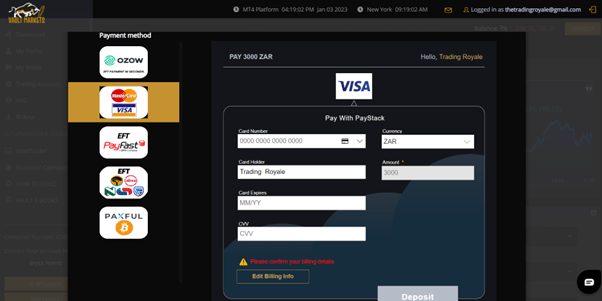

Client area

1. Select “Deposit” on your personal or corporate Vault Markets dashboard.

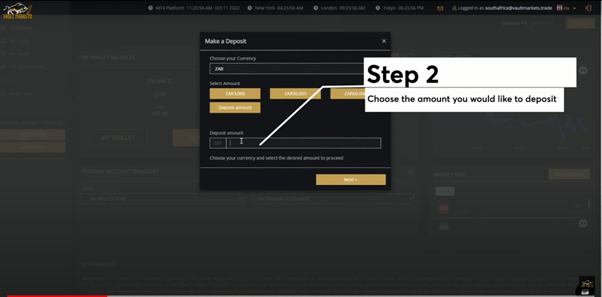

2. Enter the amount that you would like to deposit

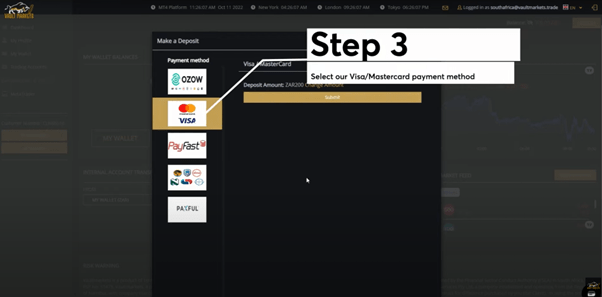

3. Select VISA/Mastercard.

4. Enter your banking details.

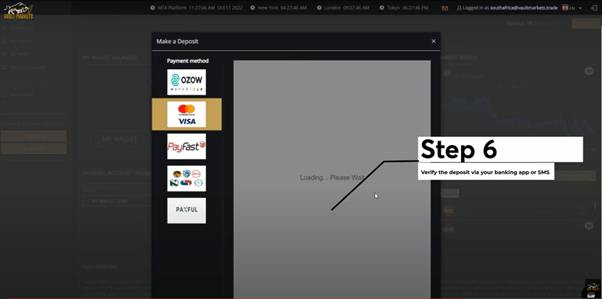

5. Verify your deposit via your banking app or SMS.